Sports Goods Sector in India

The sports goods industry in India is nearly a century old and has flourished due to the skills of its workforce. Being labour-intensive in nature, the industry provides employment to more than 500,000 people. The nucleus of this industry in India is in and around the states of Punjab and Uttar Pradesh. The industry exports nearly 60 per cent of its total output to sports-loving people the world over.

“Jalandhar in the state of Punjab and Meerut in the state of Uttar Pradesh account for nearly 81.8 per cent of total production. Together, the two towns house more than 3,000 manufacturing units and 130 exporters.About 60 per cent of the sports goods manufactured in Jalandhar consist of different kinds of inflatable balls.The Indian sports goods industry also has a presence in the cities of Mumbai, Kolkata and Chennai, albeit at a lower scale.”9

Highlights

- “Total toys, games, and sports requisites (HS – 95) export stood at US$ 417.43 million in FY19 and reached US$ 404.13 million in FY20.

- The total toys, games, and sports export was US$ 365.01 million in April 2020 to February 2021.

- The total sports goods export accounted for US$ 121.15 million from April 2021 to July 2021 and for the month of July 2021 it was US$ 41.88 million.

- In FY21, the total sports goods export accounted for US$ 268.52 million and for the month of March 2021 it was US$ 24.03 million.

- Top destinations for export of sports goods in FY21 were US, China, UK, Australia and Germany.

- Top ten destinations for export of sports goods in FY19 were US, UAE, UK, Australia, Germany, Netherlands, France, South Africa, Sweden, and Canada.

- Major exported items were inflatable balls and accessories, nets, general exercise equipment, boxing equipment, toys and games, protective equipment, cricket equipment, sportswear, carrom boards and hammock.

- Indian sports products have been exported for global events.

- India has emerged as the leading international sourcing destination for inflatable balls and other sports goods for international brands such as Mitre, Lotto, Umbro and Wilson.”10

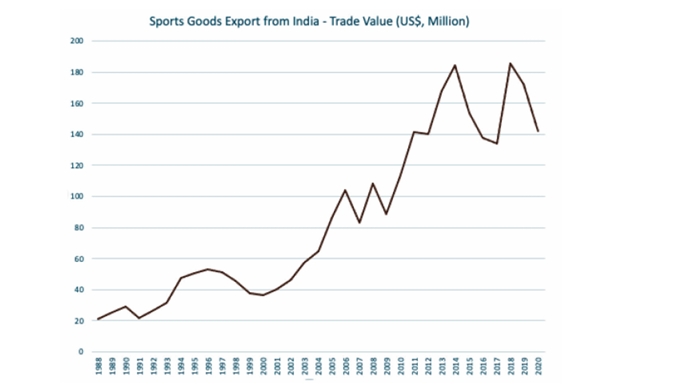

In global market, major competitors for Indian sports goods industry at large are world leader China, and traditional rival Pakistan. In the year 2020, while India and Pakistan exported sports goods worth USD 142 million and USD 178 million respectively; China exported around USD 16 billion worth of sports goods (HS 9506). In terms of growth, from 2006- 2020, CAGR for exports for Pakistan, India and China were -4%, 2%, and 9% respectively (Calculations done on UN COMTRADE data).

Jalandhar Cluster

One of the two major sports goods producing clusters, Jalandhar sports goods cluster came into existence post-independence with immigration of skilled workforce from Pakistan. In 1947, after partition, the entrepreneur belonging to one community decided to shift from Sialkot.The workers belonging to that community also migrated along with the entrepreneurs. As per the resettlement plan of Government of India, initially these migrants settled in Batala but later on shifted from Batala to Jalandhar.11

Majority of the enterprises in the cluster are micro and small having annual turnover of upto INR 10 crore. As per business owners interviewed, some enterprises are in the 10 – 100 cr range, and a very few turning over above 100 cr. Almost all of these enterprises share the challenges faced by the larger MSME sector in Punjab in general. Some of these are systemic and external, while others are firm specific and internal. Please refer to Policy Watch 10.12 for some of these studied earlier. Over recent decades, there has been a shift from core sporting equipment to such as bats, racquets, inflatable balls, etc. to include peripherals such as sportswear and performance footwear.

While there are thousands of manufacturers in the Jalandhar cluster area, the cluster may be understood in a pyramid structure.An overwhelmingly large proportion of manufacturers are producing unbranded products for the mass market, with practically no product differentiation. This base-of-the-pyramid enterprises apparently have very little focus on quality. Right above are the ones offering some differentiation either in the product or in the order fulfilment service. Still higher are the ones which are exporting the unbranded low differentiation products to the market. A handful of enterprises in this segment have invested into newer production technology, such as composites, to offer quality products.

From mid and above within the pyramid are the ones with better focus and control over quality. Few of these also manufacture for mass or premium international brands. However, the product range in this segment is limited.At the top of the pyramid are manufacturers that have taken the less travelled brand route. These manufacturers have successfully established their brands at least domestically by offering quality products utilising supply chains that ensure quality raw materials, and may well be on their way to become international brands.

There are traditional networks within the Jalandhar cluster which are more often than not overbearing for professionalisation of the enterprises and expansion of the cluster at large. Clan based groupings seem to have given rise to intense rivalry among enterprises in the cluster. There is very little knowledge sharing outside closed groups, pretty much no cooperation among competitors in developing products for the export market, or in development of vendors, etc. As the absolute export numbers and growth rates suggest, manufacturers in India seem to be fighting for crumbs while the Chinese take away the whole cake.

Total exports (20-21) 9506: 147.56 mill

Punjab + UP (20-21) 9506: 101.18 mill

Punjab (20-21) 9506: 54.89 mill

Chart 1: Sports goods exports from India,Value (Million USD); Source: COMTRADE

Factor Conditions

Human resources

The Jalandhar sports goods cluster is a labor-intensive manufacturing cluster with high quality of major products, such as inflatable balls, being hand made. About 60 per cent of the sports goods manufactured in Jalandhar are different kinds of inflatable balls and provide direct employment to thousands of workers.12 As per DIC Jalandhar, there are around 5000 highly skilled workers in the cluster, with overall workers numbering greater than 10000.“It is found that the firms in cluster employ less than 10 workers. The main reason behind it is to avoid the provisions of The Factories Act, 1947. Further, due to the seasonal demand of sports goods, the firms do not employ permanent workers rather workers are appointed as per the demand. When the demand increases, job workers are appointed to fulfill that demand. Further, the presence of subcontractors in the cluster assures the availability of products as soon as demand arises.”13

As to inflatable ball manufacturing, which is the main sports item from Jalandhar cluster, subcontractors act as an important link between firms and ball stitchers with lower number of formal stitching centres and large proportion of work being done in home-based locations. Most ball stitchers are women largely from a lower-caste background, who are paid on per- piece basis.

Raw Material

The raw material availability was one of the key determinants in establishment of sports goods cluster at Jalandhar, among other factors.“..Due to its location near the foothills of Himalayas which assured regular supply of wood and further the presence of leather cluster” in the city, Jalandhar sports goods cluster has enjoyed easy availability and price advantage with regard to these two materials.14 However, over recent years, introduction of new technologies, diversification of product portfolio to include peripherals, and production of equipment for global brands has shifted the raw material demand. The Jalandhar cluster now depends on other states in India, e.g. feathers from Andhra Pradesh, and countries like China as well for fulfilling its raw material needs.15

Capital/ Credit

Most players in the cluster appear to use own capital for working capital and expansion requirements. Generally, there is very little reliance on credit for fulfilling capital needs.“It can be due to the high rate of interest on loan but the main factor contributing to lesser problem of finance is low fixed capital base of the majority of firms. As most of the operations of the firms are skill based, the requirement of fixed capital is low and the firms generally go for their own sources.”16

Knowledge Resources

By and large, there is very little knowledge development and assimilation in the cluster. Despite the presence of very old and reputed associations in the cluster, knowledge about level of technology, information about product or process specific vendors, or even price discovery, is at pretty much non-existent.As to capability of workers and firm, studies suggest a lack of training within or without firms. “Most of the firms do not give training to their workers as they think that the workers borne the skills from their forefathers and there is no need to give training to them.There is absence of any training institute in the cluster.”10

Demand Conditions

Domestic

Overall,“the Indian sports and fitness goods market attained a value of USD 3,944.8 million in 2020.The market is further estimated to witness a CAGR of 8.9% during the forecast period of 2022-2027 to reach USD 6,579.5 million by 2026.”17 Cluster has had a robust domestic institutional demand, such as schools, higher educational institutions and sports institutions, which has been impacted by the pandemic.18 Import data from UN COMTRADE suggests a large domestic market for sports goods in India (Chart 2), with total value of imports being higher than total exports in the HS9506 category. In the calendar year 2020, Indian imports were around USD 200 million.19

Exports

Exports of sports goods from India have been on the rise in recent decades (Chart 1). As per Directorate General of Commercial Intelligence and Statistics or DGCIS, out of USD 148 million total exports of sports goods (HS9506) from India in the year 2020-21, Uttar Pradesh and Punjab accounted for USD 101 million, or roughly 70%. Punjab alone accounted for 38% or around USD 55 million.20 As per Sports Goods Manufacturers and Exporters Association or SGMEA based in Jalandhar, around 90% of sports goods produced in Punjab are produced in the Jalandhar cluster.21 Therefore, an estimated export of sports goods from Jalandhar cluster was around USD 50 million in the year 2020-21. As per Sports Goods Export Promotion Council, “[t]he main customers for the international market are foreign customers, Government department, firms and institutions of various countries like UK, Australia, USA, South Africa, France, Germany etc.”

Chart 2: Sports goods imports in India,Value (USD, Million); Source: COMTRADE

Firm Strategy, Structure and Rivalry

Traditionally, the sports goods cluster in Jalandhar has been dominated by two clans, viz. Kohlis and Mahajans. There are multiple manufacturers and export houses bearing these names in Jalandhar, and in Meerut sports goods cluster as well. As per Jhamb (2016), there has been entry of other communities into the industry which apparently has been a source of new ideas leading to a dynamic sports goods cluster. Majority of enterprises in the cluster are micro and small having annual turnover of upto INR 10 crore. As per business owners interviewed, some enterprises are in the 10 – 100 cr range, and a very few turning over above 100 cr.

The rivalry in the cluster is intense, to say the least, especially in the sub-INR 10 crore range that seems to depend on custom/ mixed orders in the non-branded product segment.There is very little information sharing on vendors, prices, specifications or technology employed. The firms are sensitive in terms of employees getting work at rival firms, with most workers or staff spending whole career at one firm. It appears to be one of the challenges that hinders dynamic growth of the firms as well as the cluster at large.

Ecosystem of Support Institutions

Policy Making and Regulatory Institutions

Overarching policy framework that covers the Jalandhar cluster is same as that of the larger MSME sector, with its own merits and demerits. Please refer to PW 10.12 for further information. There is an absence of an institution or a government agency engaged in policymaking specific to sports goods manufacturing. However, policy decisions taken or schemes implemented at the national level (such as TOPS, Khelo India, etc.) and even in other states (Hockey hub in Odisha) with regard to promotion of sports directly impact business for Jalandhar cluster.

Sports Goods Foundation of India (SGFI)

In the Jalandhar cluster, specific to the domain labour, it has largely been self-regulation post interventions by UN agencies.“UNIDO has worked with the Jalandhar Sports Goods Cluster between the years 2002 and 2005 under its Cluster Development Programme and from May 2005 to Dec 2008 under in its new global research project of ‘Cluster Development Programme and Corporate Social Responsibility (CSR).”22 The program was aimed at regulating high incidence of child labour in the cluster under the overarching framework of the Altlanta Agreement with Sports Goods Foundation of India acting as nodal agency.23

Sports Goods Foundation of India or SGFI is Jalandhar based non-governmental membership- based body, consisting of 30 major manufacturers and exporters of inflatable balls, focused on the issue of child labour prevention and rehabilitation of children saved from labour. In partnership with government and international bodies, SGFI conducts awareness programs and monitors the situation of labour among more than 3300 families involved in manufacturing sports goods, with over 15000 ball stitchers.24

Promotional Institutions

Sports Goods Exports Promotion Council (SGEPC)

Established in 1958, SGEPC is GoI sponsored organisation with an aim of promoting exports of sporting goods from India. Over years, with reclassification of commodities in international trade, SGEPC has included toys under its purview as well (HS 95 commodities). “SGEPC provides important information to the members on market intelligence, standards & specifications, quality & design, and on any other issue which may directly or indirectly affect the industry. SGEPC, also acts as a link between the industry and the Government whereby it provides feedback on industry’s requirements to the Indian Government and also informs Government directives to the industry. It collects export data from its members, maintains a statistical record of exports of sports goods and toys and evaluates its performance on an annual basis.”25 Perhaps the most recognised activity that SGEPC organises is the annual awards to top exporters with the HS9506 category goods. As to the contribution to the Jalandhar cluster, the distance, both in location as well as the majority of the enterprises in the cluster that are micro and small, acts as a barrier.

Process cum Product Development Centre

Process cum Product Development Centre (PPDC) for Sports Goods based in Meerut that has an Extension Centre housed within Central Institute for Hand Tools (CHTI) at Jalandhar.

26The PPDC Extension Centre could not be reached for understanding its contribution to the cluster, and most respondents interviewed were not aware of the same. The Centre at Meerut offers services in developing and testing products in wood, leather, rubber and plastic, etc., apart from offering skill development courses. The services offered at the Extension Centre at Jalandhar could not be verified.

Sports Goods Manufacturers and Exporters Association (SGMEA)

SGMEA (http://sgmea.org/), established in 1973, is biggest of the many industry associations of sports goods manufacturers in the Jalandhar Cluster. In theory, SGMEA is also open to manufacturers and exporters in the Meerut cluster, but the membership from other states is severely missing. Nonetheless, the members from Jalandhar cluster itself represent a high proportion of manufacturers and exporters in the country. The activities by the association have been limited, perhaps due to the lack of a secretariat that reduces the continuity. There is great potential in the association to act as a knowledge generation and dissemination platform, and also actively make inputs for better policies at the state and national level.

Footnotes:

9. https://www.ibef.org/pages/34747

10.https://www.ibef.org/exports/sports-industry-aspx

11. http://www.pbr.co.in/2016/2016_month/February/15_A1_PriyaJhamb.pdf

12. http://sgmea.org/sports_goods_industry_of_india

13. http://www.pbr.co.in/2016/2016_month/February/15_A1_PriyaJhamb.pdf

14. http://www.pbr.co.in/2016/2016_month/February/15_A1_PriyaJhamb.pdf

15. https://indianexpress.com/article/cities/chandigarh/jalandhars-rs-1700-crore-sports- goods-industry-bleeds-6422169/

16. http://www.pbr.co.in/2016/2016_month/February/15_A1_PriyaJhamb.pdf

17. https://www.expertmarketresearch.com/reports/indian-sports-and-fitness-goods-market

19. https://comtrade.un.org/data/

20. http://www.dgciskol.gov.in

21 http://sgmea.org/sports_goods_industry_of_india

22. http://sgmea.org/sports_goods_industry_of_india

23. https://open.unido.org/api/documents/4849206/download/Global%20Value%20Chains,%20Local%20Clusters% 20and%20Corporate%20Social%20Responsibility%20 23.20A%20Comparative%20Assessment%20of%20the%20Sports%20Goods%20Clusters%20in%20Sialkot,%20Pakistan%20and%20Jalandhar,%20India

24. https://www.sgfi.org//uploads/pages_file/1505299436.pdf

25. http://sportsgoodsindia.org/AboutUs.aspx

26.http://www.ppdcmeerut.com/?_ga=2.31018424.644624596.1647492915-1647492912