Production Linked Incentives (PLI) Scheme – An Introduction

The Production-Linked Incentive scheme was introduced by the central government in March 2020. The scheme provides an incentive of 4-6% to eligible companies on sales of goods manufactured in India for a period of five years.

Objectives of the Scheme

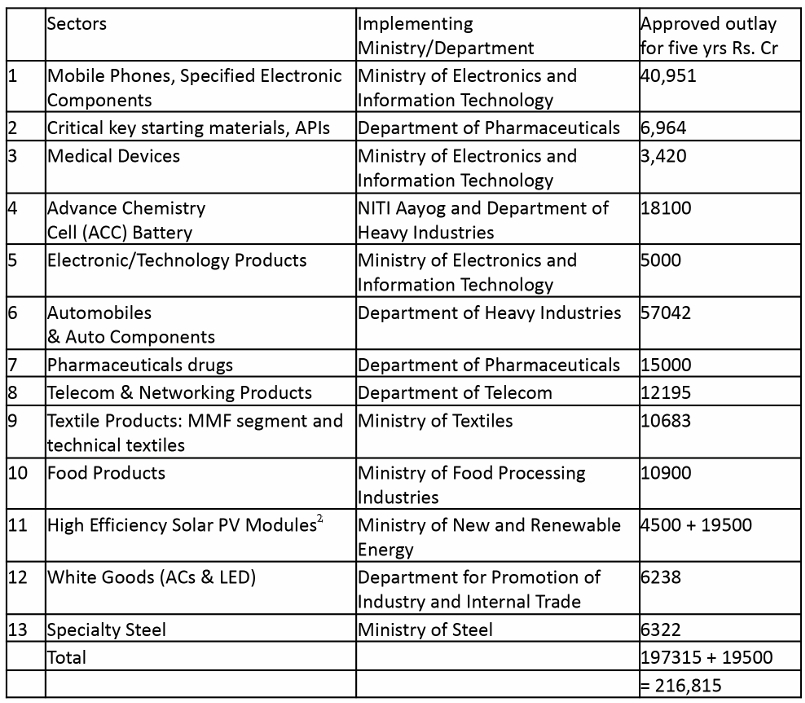

Apart from inviting foreign companies to set shop in India, the scheme also aims to encourage local companies to set up or expand existing manufacturing units. Apart from cutting down on imports, the PLI scheme also looks to capture the growing demand in the domestic market.Therefore, 10 more sectors were included under the scheme along with three initially announced.The sectors and the outlays are listed in the table on the next page.

The PLI scheme across various sectors aims at “making Indian manufacturers globally competitive, attract investment in the areas of core competency and cutting-edge technology, ensure efficiencies, create economies of scale, enhance exports, and make India an integral part of the global supply chain.” In order to reduce India’s dependence on China, the government announced this scheme that aims to give companies incentives on incremental sales from products manufactured in domestic units.

The government estimated that about 223 applicants invested Rs 23,991 crore under the Modified Special Incentive Package Scheme (MSIPS), which was revised in 2015. These investments were led by companies including Samsung, Bosch, Sterlite and Chinese mobile phone manufacturers such as Vivo and Oppo. The scheme provided a major boost to electronics manufacturing in the country. After this scheme closed last year, the government followed it up with three mega incentives totaling about Rs 50,000 crore, with a significant chunk reserved for the PLI scheme.

The idea of PLI is important as the government cannot continue making investments in these capital intensive sectors as they need longer times for start giving the returns. Instead, what it can do is to invite global companies with adequate capital to set up capacities in India. The PLI scheme is designed to be effective in implementation and predictable in results. It should help India create a significant chunk of the jobs it needs.

Additional Investment, Output and Employment

With sectors included like mobile and allied equipment as well as pharmaceutical ingredients and medical devices manufacturing, these sectors are labour intensive and are likely, and the hope is that they would create new jobs for the ballooning employable workforce of India. The government expects the following from the PLI scheme –

- Additional sales of INR 409,501 crore including MSME revenue of INR 248,200 crore

- Additional investment of INR 102,722crore

- Additional GST collections of INR 12,686 crore

- Additional direct tax collections of INR 16,525 crore

- Additional employment of 84 lakh, including 24 lakh in MSME

Sector wise Scheme Outlay and Products supported under the scheme

Eligibility criteria of the PLI scheme

- Companies that are registered in India and are involved in the manufacturing of goods covered under the target segments of the scheme can apply.

- Eligibility under the Scheme shall be subject to thresholds of Incremental Investment (covered under Target Segments) over the base year as defined.

- An applicant must meet threshold criteria that is a minimum of INR 10 crore (MSME) or INR 100 crore (Others) and a maximum of INR 1000 crore to be eligible for disbursement of incentive for the year under To meet the threshold criteria of Incremental Investment for any year, the cumulative value of investment done till such year (including the year under consideration) over the Base Year (2019-20) shall be considered.

- The applicant can operate existing or new manufacturing unit at one or more locations in the country.

- Any additional expenditure incurred by companies on plant, machinery, equipment, research and development and transfer of technology for manufacture in the target segments will be eligible for the incentive scheme.

Basis of calculation of incentive under the PLI Scheme

The scheme shall extend an incentive of 4% to 6% on incremental sales (over base year i.e. 2019-20) of goods manufactured in India and covered under target segments, to eligible companies, for a period of five years subsequent to the base year.

Applying for benefits under the PLI Scheme

Application can be made by any company registered in India. The application process is set out below:

- The number of applications allowed per applicant for support under the Scheme shall be restricted to one.

- Project Management Agency (PMA) / MeitY to receive the application (through an Online Portal) for prima facie examination and issue acknowledgement within 15 days post completion of examination.

- Each application shall be reviewed and details shall be entered in the detailed checklist by the PMA upon receipt of the application.

- The PMA will accordingly make appropriate recommendations to the Technical Committee (TC) for approvals under the Scheme.

- The final recommendations of the PMA and the Technical Committee shall be placed before Empowered Committee (EC) for its approval.

- All the applications shall be finalized within 60 days from the date of issuance of acknowledgement of receipt of the application.

- An approval letter to applicant will be sent within 5 working days of receiving approval from the Competent authority.

It can be concluded that all these were categorically designed to focus on those who were planning to move out of certain domains for other countries, as part of the global reset post pandemic, to keep their value chain intact without having to depend on one source.

The PLI Scheme’s very nature benefits those with scale and helps both domestic market and shipping the surplus to global market, boosting both manufacturing and exports.

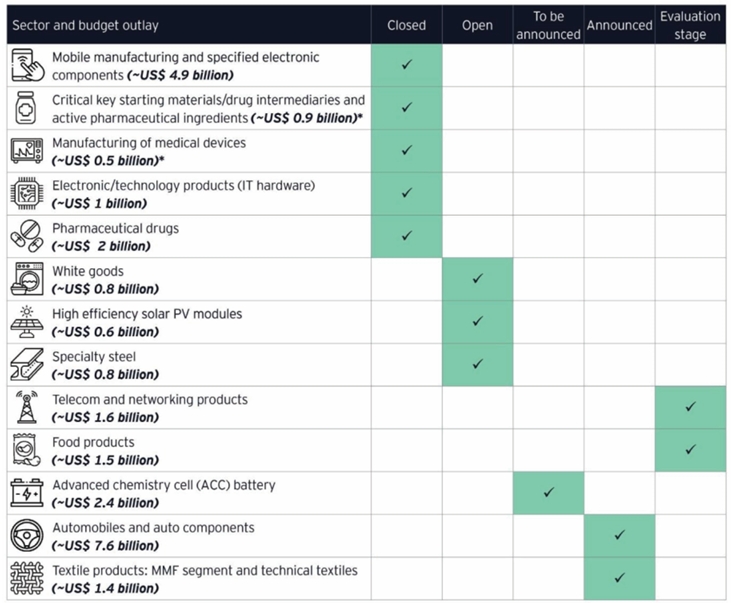

Sector-wise Status of Production-Linked Incentive Schemes

In the notified PLI Schemes, the update on their implementation is as below:3

Mobile Manufacturing and Specified Electronic Components

The scheme extends an incentive of 4% to 6% on incremental sales for a period of five years subsequent to the base year.The scheme was notified on 01.04.2020; last date for application was 31.07.2020 and the scheme commenced on 01.08.2020.The scheme has received a very encouraging response. Sixteen applications worth Rs. 35,541 crore under this scheme have been approved under the first round of the scheme (5 companies under Global Champions Category, 5 companies under Domestic Champions Category and 6 companies under the Electronic Components category) with an incentive outlay of INR 36,440 crore.

As per the Quarterly Review Reports for the quarter ending December 2020, in the first 5 months of scheme operation and despite challenging times, the applicant companies have produced goods worth ~INR 35,000 crore and invested ~INR 1,300 crore under the scheme. Additional employment generation during this period stands at around 22,000 jobs.

After the success of the First Round of PLI Scheme, the Second Round of PLI Scheme has been launched on 11.03.2021, which focuses on building a vibrant and robust electronic component manufacturing ecosystem. The last date for application was 31.03.2021. Under the Second Round, incentive of 5% to 3% shall be extended on incremental sales (over base year, i.e., 2019-20) of goods manufactured in India and covered under the target segment, to eligible companies, for a period of four years.Applications received under the Second Round of PLI Scheme for Large Scale Electronics Manufacturing are in the process of appraisal.

Response of major industry leaders: The approved companies under the PLI Scheme for Large Scale Electronics Manufacturing include Samsung, Foxconn Hon Hai, Rising Star, Wistron and Pegatron. Out of these, three companies namely Foxconn Hon Hai, Wistron and Pegatron are contract manufacturers for Apple iPhones.Apple (37%) and Samsung (22%) together account for nearly 60% of global sales revenue of mobile phones and this scheme is expected to increase their manufacturing base manifold in the country.

Indian companies including Lava, Bhagwati (Micromax), Padget Electronics, UTL Neolyncs and Optiemus Electronics were approved under the scheme.These companies are expected to expand their manufacturing operations in a significant manner and grow into national champion companies in mobile phone production.

Value addition- new types of industries, encouragement to MSMEs/ ancillarisation, etc: The PLI Scheme for Large Scale Electronics Manufacturing also focuses on building a vibrant and robust electronic components manufacturing ecosystem.This step will further strengthen product manufacturing in India for multiple sectors such as IT Hardware, LED Products, Automotive, Medical Devices, Solar Cells, Energy Storage, etc. for which other PLI Schemes are going to be implemented.

Expected outcomes are in terms of increase in investment, production, exports and employment. Over the next five years, the Scheme is expected to lead to a total production of about INR 10.5 lakh crore. More than 60% of production is expected to be exported.The scheme is also expected to bring in additional investment of INR 11,000 crore.Value addition is expected to go up from 20-25% presently to 35-40% by 2025. The scheme will generate approximately 2 lakh direct employment opportunities in next 5 years along with creation of additional indirect employment of nearly 3 times the direct employment.

Pharmaceuticals: Critical KSMs / Drug Intermediates and APIs

With an objective to attain self-reliance and reduce import dependence in these critical Bulk Drugs – Key Starting Materials (KSMs)/ Drug Intermediates and Active Pharmaceutical Ingredients (APIs)in the country, the Department of Pharmaceuticals had launched a Production Linked Incentive (PLI) Scheme for promotion of their domestic manufacturing by setting up greenfield plants with minimum domestic value addition in four different Target Segments (In Two Fermentation based – at least 90% and in the Two Chemical Synthesis based – at least 70% ) totaling 41 products with a total outlay of Rs. 6,940 cr. for the period 2020-21 to 2029-30.

Response of Industry Leaders- In the PLI Scheme for Bulk Drugs, the major successful players/ participants include M/s.Aurbindo Pharma Group, M/s. Hetero Group, M/s. Karnataka Antibiotics and Pharmaceuticals Limited, M/s. Kinvan Pvt. Ltd, M/s. Natural Biogenex Private Limited, etc.These include global players with strong presence in advanced markets.

Approvals: In total 215 applications have been received for the 36 products spread across the four Target Segments for the PLI schemes for Bulk Drugs from all over the country. Out of these, 47 applications have been approved by the Government, with a total Committed Investment of Rs. 5,366.35; Maximum Incentive proposed for disbursement: Rs. 6,000 crore and Expected Employment Generation of about 12140.

Medical Devices

With an objective to boost domestic manufacturing, attract large investment in Medical Device Sector, the Department of Pharmaceuticals had launched a Production Linked Incentive (PLI) Scheme for Promotion of Domestic Manufacturing of Medical Devices to ensure a level playing field for the domestic manufacturers of medical devices with a total financial outlay of Rs.3,420 cr. for the period 2020-21 to 2027-28.

Response of Industry Leaders- In the PLI Scheme for Medical Devices, the major successful players/ participants include M/s. Siemens Healthcare Private Limited, M/s. Wipro GE healthcare Private Limited, M/s BPL Medical Technologies Private limited, M/s Nipro India Corporation Private Limited, M/s. Sahajanand Medical Technologies Private Limited, M/s. Integris Health Private Limited, M/s. Poly Medicure Limited, etc.

Approvals – In total 28 applications have been received spread across the four Target Segments for the PLI schemes for Medical Devices from all over the country. Out of these, 14 applications have been approved by the Government, with a total Committed Investment of Rs.873.93 crore; Maximum Incentive proposed for disbursement: Rs.1,694 crore and Expected Employment Generation of about 4212.

White Goods (ACs & LED)

The PLI Scheme for White Goods shall extend an incentive of 4% to 6% on incremental sales of goods manufactured in India for a period of five years to companies engaged in manufacturing of Air Conditioners and LED Lights.

PLI Scheme is designed to create complete component ecosystem in India and make India an integral part of the global supply chains.The scheme will be instrumental in making manufacturing in India globally competitive by removing sectoral disabilities, creating economies of scale and ensuring efficiencies. The scheme is expected to attract global investments, generate large scale employment opportunities and enhance exports substantially.

It will also lead to investments in innovation and research and development and up gradation of technology.The Scheme is expected to be instrumental in achieving growth rates that are much higher than existing ones for AC and LED industries, develop complete component eco-systems in India and create global champions manufacturing in India. A number of global and domestic companies, including a number of MSMEs are likely to benefit from the Scheme.

Response of the major Industry leaders- The Scheme has been prepared in consultation with relevant stakeholders such as manufacturers of Air Conditioners and LED Lights Manufacturers and related Industry Associations and they are looking forward to the scheme being launched.

Promotion of the scheme overseas specifically targeted at identified global majors in relevant fields by Project Development Cell (PDC) of DPIIT, in coordination with Invest India. This would also include disseminating mailers to the Embassies of India in home countries of identified global majors in ACs and LED Lights industry. This would be followed byWorkshops/ Webinars by CII, FICCI, ASSOCHAM, RAMA, CEAMA and ELCOMA for raising awareness about the scheme.

Value addition- As per the Industry, the Value addition for AC Industry will increase from current level of 20-25% to 75% and for LED Lights Industry from 40% to 70-75%; This would also result in starting manufacturing of components or sub-assemblies which are not manufactured in India presently.

Outcome of the Scheme- It is estimated that over the period of five years, the PLI Scheme will lead to incremental investment of Rs. 7,920 crore; incremental Production worth Rs. 1,68,000 crore; exports worth Rs 64,400 crore ;earn direct and indirect revenues of Rs 49,300 crore and create additional four lakh direct and indirect employment opportunities.

High Efficiency Solar PV Modules

Presently, solar capacity addition in the country depends largely upon imported solar PV cells and modules as the domestic manufacturing industry has limited operational capacities of solar PV cells and modules. Major achievement of this PLI Scheme for High Efficiency Solar PV Modules is the likely reduction of import dependence in a strategic sector like electricity.

Response of major industry leaders- Industry stakeholders, consulted at the preparation stage of this Scheme, have shown overwhelming response, and are willing to set- up large, vertically integrated manufacturing capacities which will help to achieve economies of scale, thereby becoming globally competitive. In order to undertake global reach of this Scheme, MNRE will again interact with global industry leaders, write to various solar manufacturer’s associations, as well as requesting the various Indian embassies abroad to inform the potential investors in their respective countries.

Value addition – New types of industries, encouragement to MSMEs/ancillarisation etc. Manufacturers will be incentivized for higher efficiencies of solar PV modules and also for sourcing their material from the domestic market. Thus, the PLI Scheme will help not only in setting up of domestic manufacturing capacities in upstream stages of solar PV manufacturing, like poly silicon and wafers which are presently absent in the country, but is likely to augment the entire solar PV manufacturing ecosystem, including boost to ancillary units and MSMEs.

The outcomes/ benefits expected from the scheme are – Additional 10,000 MW capacity of integrated solar PV manufacturing plants. Direct investment of around 17,200 crore in setting up solar PV manufacturing projects; Direct employment of about 30,000 and Indirect employment of about 1,20,000 persons; Import substitution of around 17,500 crore every year; Demand of 17,500 crore over 5 years for ‘Balance of Materials’ such as, Solar Glass, EVA, Backsheet, Junction Box, Ribbon etc. will lead to development of new types of industries where MSMEs will play a major role; Provide impetus to Research & Development to achieve higher efficiency in solar PV modules.

Food Products

Production Linked Incentive Scheme for Food Processing Industry was approved by the Cabinet on 31.3.2021 for implementation during 2021-22 to 2026-27 with an outlay of Rs 10,900 crore. The scheme is essentially meant for Indian companies and subsidiaries of MNCs operating in India with minimum sales of food products manufactured in India. The scheme will encourage investment in four food segments viz. Ready to Cook/ Ready to Eat (RTC/RTE) including millet based foods, Processed Fruits & Vegetables, Marine Products, Mozzarella Cheese.

The objective of the scheme is to support creation of global food manufacturing champions; support Indian brands of value-added food products in the international markets; increase employment opportunities for off-farm jobs and ensuring remunerative prices of farm produce and higher income to farmers.

Response of major industry leaders- The scheme has been well received by the Industry including Nestle, ITC, Britannia, KeventerAgro, andAmul. Companies would be reached out through Indian Missions abroad. Industry Associations would be supporting to organise Webinar to attract potential investors to avail opportunities under PLIS. As the incentive is based on sales, subject to minimum investment, higher value addition is inbuilt in the scheme. Further, product specific incentive is extended for value added Marine products viz. Canned, Battered & breaded, Pickles, Sausages etc.

Role of contract Manufacturing has been recognized under the scheme and the scheme provides for Investment criteria to be met by the food majors and their contract manufacturers jointly. These products are extended 10% incentives for all the six years of scheme duration. Small and medium enterprises (SME), in the four segments will also be supported for manufacture innovative and organic products.This segment has been earmarked an outlay of Rs. 250 crore. The scheme envisages for holistic development of the sector.

The outcomes/ benefits expected from the scheme are – Expansion of food processing capacity: Rs 33,494 crore; Exports: Rs 27,816 crore; Generation of employment: 2.5 lakh persons.

Telecom and Networking Products

Department of Telecommunications has notified the PLI Scheme for Telecom and Networking products on 24th February 2021 with financial outlay of Rs. 12,195 Crores, over five years for Telecom and Networking Products.

PLI Scheme in Telecom and Networking Products will make India a global hub of manufacturing telecom equipment including Core Transmission Equipment, 4G/5GNext Generation Radio Access Network and Wireless Equipment, Access & Customer Premises Equipment (CPE), Internet of Things (IoT) Access Devices, Other Wireless Equipment and Enterprise equipment like Switches, Routers etc.

The investor will be incentivized for incremental sales up to 20 times the committed investment enabling them to reach global scales and utilize their unused capacity and ramp up production.

The core component of this Scheme is to offset the huge import of telecom equipment worth more than Rs. 50 thousand crores and reinforce it with “Made in India” products both for domestic markets and exports. The target is to Make India a preferred global manufacturing destination for telecom products and making India a net exporter of telecom and networking products.

Response of major industry leaders- Most of the world telecom industry leaders are keen to expand or set up manufacturing base in India and are positive with the kind of incentives proposed in the Scheme. The companies like Ericsson Sweden and Nokia Finland are keen to expand their existing operation in India for global supply chain.

Global telecom companies like Samsung South Korea, Cisco USA, Ciena USA, and Engineering Manufacturing Services (EMS) companies like Jabil USA, Foxconn Taiwan, Sanmina USA& Flex USA have shown interest to set up manufacturing in India for Telecom & Networking Products for domestic as well as export markets. Indian manufacturers like VVDN Technologies Gurugram, Dixon Noida, HFCL, Coral Telecom& Sterlite have also shown interest in the Scheme.

How to undertake global reach- An extensive outreach program with the support of Invest India team for the Scheme is being planned, covering – One to one meeting with potential investors; Participation in global outreach events organized by industry associations; Webinars with Consultants& Embassy officials, Law firms/ banks/research organisations/ industry associations; Creation of collaterals/flyers for the scheme in different languages; Microsite for the scheme on Invest India website.

Separate interactive website for Applications as well as selected vendors for the entire Scheme interface; Support translation of scheme into multiple languages.

Value addition- The Scheme is investment linked which will enable the vendors to invest in backward integration thereby increasing the value addition in country. Global vendors will bring in their component suppliers and develop ancillaries.

The scheme has a special category for MSME recognizing the fact that MSMEs play an important role in the telecom manufacturing eco system. For MSMEs, one percent (1%) higher incentive is proposed in initial 3 years. Minimum Investment threshold for MSME has been kept at Rs. 10 crore.

Expected outcomes – It is estimated that full utilisation of the Scheme funds is likely to lead to incremental production of around 2.4 Lakh crore with exports of around 2 Lakh crore over 5 years. It is also expected that Scheme will bring investment of around 3,000 crore and generate huge direct and indirect employment.

IT Hardware

Major achievements- The PLI Scheme for IT Hardware was notified on 03.03.2021.The last date for application is 30.04.2021.The scheme shall extend an incentive of 4% to 2% / 1% on net incremental sales (over base year) of goods manufactured in India and covered under the target segment (Laptop,Tablets, All in one PCs, Servers) to eligible companies, for a period of four years.

The scheme is likely to benefit major global as well as domestic manufacturers of IT hardware products, namely, Laptops,Tablets, All-in-One PCs, and Servers.This is an important segment to promote manufacturing as there is huge import reliance for these items at present.

Undertaking Global Reach- The Global outreach plan mainly includes a two pronged approach. I) Identification and focused approach to Global Champion companies – The decision makers of global champion companies are identified and reach out is done through various channels, e.g., Indian Embassies abroad, Foreign Embassies in India, Electronics Industry Associations, Bank networks, Consultants, Supply chain companies, etc.

One-to-one physical or VC meetings are conducted at various levels involving Minister, Secretary and Joint Secretary MeitY. The relevant materials, viz., Scheme Notification and Guidelines are translated into foreign languages (Korean, French, German, Mandarin, Japanese, Hebrew, etc.) and are shared with relevant stakeholders for wider dissemination. II) Promotion of the schemes through relevant stakeholders to reach a greater audience – Various Webinars, Round table and Panel discussions are organised through various stakeholders, like Indian Embassies abroad, Foreign Embassies in India, Electronics Industry Associations, OEMs and their Supply chain partners, Banks and consultant networks, etc. where details of the schemes are explained through Presentation and Q&A sessions. This approach helps in reaching out to new companies.

Value addition- The scheme is likely to benefit major global as well as domestic manufacturers of IT hardware products, namely, Laptops,Tablets,All-in-One PCs, and Servers. This is an important segment to promote manufacturing as there is huge import reliance for these items at present.

Expected outcomes – Over the next 4 years, the PLI Scheme for IT Hardware is expected to lead to total incremental production of up to INR 3,26,000 crore, out of which more than 75% is expected to be exported. Also, it is expected that Domestic Value Addition for IT Hardware will rise to 20% – 25% by 2025 from the current 5% – 10%, due to the impetus provided by the scheme. The scheme will generate approximately 1.8 lakh employment opportunities in next four years.

Automobiles & Auto Components

With an outlay of INR 57,042 crore, the scheme is expected to spur manufacturing and growth of the sector and enhance its global presence.

The automotive sector is an extensive contributor to the Indian economy. India is expected to be the world’s third-largest automotive market in terms of volume by 2026. The country also holds a strong position in the international heavy vehicle arena being the largest tractor manufacturer, second-largest bus manufacturer and third-largest heavy trucks manufacturer in the world.

With 7.1% share in India’s GDP, 40% share in global research and development and 4.3% in export, the sector holds significant importance in building a self-reliant India.

Questions industry seeks clarity on4

While the scheme still awaits approval from the Cabinet, the Department of Heavy Industry should come up with draft guidelines in public domain after deep diving into the following issues raised by the industry:

- Whether joint venture would be an eligible applicant for applying for incentive under the scheme?

- Whether the manufacturing of a component that is currently being imported would be considered for computing incremental investment and consequently incremental sale?

- What is the indicative list of eligible and ineligible expenditure for computation of committed investment?

- Whether there would be separate PLI norms for new companies planning to engage in auto manufacturing?

- Whether brown field investment would be considered as an eligible investment under the scheme?

- What are the expected components/products that would be eligible to receive incentives under the scheme?

If the government can find a way to work out the challenges highlighted above, it will herald a new path for the Indian automotive and auto components sector.

Govt includes CNG, LNG, 98 other advanced tech under auto PLI scheme5

The Union government has added more than 100 advanced technologies, including alternate fuel systems such as compressed natural gas (CNG), under the production-linked incentive (PLI) scheme for the automobiles. Bharat Stage VI compliant flex fuel engines, electronic control units (ECU) for safety, advanced driver assist system, e-quadricyle, among others will also be covered under the scheme.Till now, the government has included only two-wheelers and four-wheelers under the scheme.

The scheme aims to boost manufacturing capability of the automobile sector, including the electric and hydrogen fuel cell vehicles. The scheme aims to incentivise high-value advanced automotive technology vehicles and products such as sunroofs, adaptive front lighting, automatic braking, tyre pressure monitoring system, and collision warning systems, among others for the auto industry.

The Society of Indian Automobile Manufacturers said it is thankful and compliments the Ministry of Heavy Industries for coming out with a structured list of PLI parts and procedural details in a very short time.“Our preliminary observation is that the list of AAT parts is broad-based and well — structured across themes,” said Rahul Bharti, chief engagement officer, Siam.

The inclusion of e-quadricyle is another highlight of the notification and set to benefit firms including Bajaj Auto, M&M. While Bajaj Auto sells the internal combustion engine powered Qute in the export markets, M&M showed the battery operated quadri at the last auto expo but has yet to launch it commercially.

COVID-19 impact and scope of the PLI scheme for the auto sector

The auto sector has been one of the adversely affected sectors during the pandemic. While the sales have been lowest in the last 20 years, there has also been a dip in the volume of both the new-vehicles and used-vehicles industries. However, despite a sluggish market environment in the financial year2020-21, overall automobile exports grew 56.55% in March 20213 and the scheme would be instrumental in reviving the growth potential of the sector.

The PLI scheme for the auto sector is interlinked with the scheme for Advance Chemistry Cell (ACC) battery storage.With the cabinet approving the scheme for ACC battery storage production in May 2021, the government has set its sight on making India more environment- friendly and slowly phase out petrol and diesel-based vehicles.

Incentives under the ACC battery accompanied with the scheme on auto sector will reduce the cost of manufacturing electric vehicles and thus, make it affordable for a large segment of the population. India’s EV market is estimated to be an INR 50,000 crore (USD 7.09 billion) opportunity by2025, with two-wheelers and three-wheelers expected to drive higher electrification of the vehicles.The scheme for the sector is likely to comprise of the following sub-schemes and companies will be eligible to apply for a maximum of three of these schemes:

Sourcing incentive scheme with probable outlay of around INR 7,210 crore is expected to incentivise international purchase offices for component sourcing. Champion OEM incentive scheme with probable outlay of INR 18,075 crore would provide incentives based on sales value for all auto original equipment manufacturers (OEMs).

Logistics cost incentive scheme is anticipated to have the biggest outlay with INR 23,628 crore and provide sales-based incentives to offset logistics costs. Component champion incentive scheme would focus on giving out incentives on the auto component sales based on incremental sales achieved by the manufacturers. This sub-scheme is likely to get INR 8,129 crore out of the total budget allocated to the sector.

Maximum incentive per applicant is expected to be capped at INR 8,556crore and incentive rates may range from 2-12% of the incremental sales/revenue depending on the product category and the sub scheme. Reports suggest that under the Automotive Champion scheme, a company would qualify for the PLI only if it has a revenue of INR 1000 crore (INR 100 crore for component makers) from overseas operations, INR 10,000 crore overall revenue (INR 500 crore for component makers) and global investment of INR 3000 crore (INR 150 crore for component makers). All the three criteria will be required for a company to qualify for automotive champions that will offer them maximum incentives in the form of cash backs on incremental sales.

Conclusion

Is it really fulfilling the purpose?

As stated in the beginning, the government expects the following from the PLI scheme –

- Additional sales of INR 409,501 crore including MSME revenue of INR 248,200 crore

- Additional investment of INR 102,722 crore

- Additional GST collections of INR 12,686 crore

- Additional direct tax collections of INR 16,525 crore

- Additional employment of 84 lakh, including 24 lakh in MSME

The PLI framework enables India to take definitive steps, in the near term, to expand the manufacturing potential of the economy.The pillars of the policy are:

Creation of large-scale manufacturing capacity

Since the incentives are directly proportional to production capacity/ incremental turnover, it is expected that investors will be compelled to create large-scale manufacturing facilities. Further, it is also expected to bring improvements in industrial infrastructure, benefiting the overall supply chain ecosystem.

Import substitution and increase in exports

PLI schemes intend to plug the gap between the highly skewed Indian import- export basket, which is mainly characterized by heavy imports of raw materials and finished goods.The PLI schemes are intended to enable domestic manufacture of goods, thereby causing a reduction in reliance on imports in the short term and expanding quantum of exports from India over long term.

Employment generation

As large-scale manufacturing requires large labor force, it is expected that the PLI schemes will utilize India’s abundant human capital and enable up-skilling and technical education. As it is expected that the industries will invest at least five times as much so the total investment could be Rs 9 trillion. This will add more manufacturing jobs in the globally competitive sectors. As the investment per job in these sectors is Rs 20-30 million, about 300,000 jobs could come up.

Implementation of the scheme

The PLI schemes provide eligible manufacturing companies incentives ranging from four to six percent on incremental sales over the base year of 2019-20 for a four to six-year period. It is like a subsidy being provided by direct payment – as budgeted – for domestically manufactured goods by the chosen beneficiaries.

The incentive amount offered varies across sectors and the savings generated from PLI of one sector can be appropriated towards other sectors in order to maximize returns. The PLI schemes are intended to incentivize large domestic and global players to participate in production and lead to more inclusive growth across the country.

The purpose of widening the PLI Scheme to cover more products was:

- To protect identified product areas.

- To introduce non-tariff measures that makes imports more expensive.

- To acknowledge the relevance of exports in overall growth strategy but focus more on the domestic market.

- To promote manufacturing at home by offering production incentives and encourage investments both from within and outside.

Response from various industries

PLI schemes evoke mixed response where IT, mobile steal a march on other sectors. The government had to, for instance, re-open applications for its PLI scheme for medical devices due to certain issues faced in filling up the 28 slots the first time around.

The PLI schemes for these three sectors have already crossed the expression of interest, invitation of applications and selection of participating companies stages. The schemes for mobile phone and electronic components manufacturing, information technology (IT) hardware manufacturing as well as communications networking products have shown initial promise. The schemes for these three sectors have already crossed the expression of interest, invitation of applications and selection of participating companies.

But sectors such as medical devices, textiles as well as automobile and automobile component manufacturing are struggling to find enough participants.The reasons for low interest is that most companies either do not meet the qualification norms for the scheme, or feel that the return on investment is low compared to the incentives announced.

For instance, the government had to re-open applications for its PLI scheme for medical devices due to certain issues faced in filling up the 28 slots the first time around. It was learned that while 28 applications were received the last time, as many as 15 of them were “not eligible” as they did not meet specific criteria for the categories of devices for which they had applied.6

As a result, the government was only able to fill 13 slots for the scheme’s four target segments Though, the government is also looking to receive applications for additional devices like oxygen concentrators. One of the challenges is that, at the moment, there aren’t many domestic manufacturers and whatever few are there they also do not want to invest is that low tariffs make it more convenient to rely on importing these devices.They would probably feel more confident if they felt that, with the incentives, they would be able to compete with imports.

However, the government would have to ensure availability of these devices domestically in order to be able to increase tariffs. The Department of Pharmaceuticals has been in discussions with some domestic medical device makers individually to gauge their interest. It has also been utilising Invest India platform to identify potential investors.

In the case of PLI for automobile and automobile component manufacturing, most Indian companies do not meet the qualification norms and have, therefore, avoided even applying for the scheme. This scheme was aiming at the introduction of state of the art technology in the sector. For the same, it also covers drones and drone components aiming to address the strategic, tactical and operational uses of this technology.

For textile sector, the government is now considering adding more products in the list of eligible products to attract applicants7. Similarly, the players in specialty steel sector are not very keen on applying under the scheme as they feel that the period of 5 years is too less to set up new units and start production from them or even expand old units.

The companies concern is that since the sector is extremely capital intensive, at least 10 years would be needed to see off the initial gestation period and then obtain the return on investments.

Application Flow from Various Sectors

Food, mobile and specified electronic component manufacturing, IT hardware, as well as telecom equipment manufacturing are amongst the sectors that have received the maximum number of applications under the scheme. The mobile phone and specified electronics component manufacturing, notified on April 1, 2020, had received and approved applications from 16 companies, including Apple’s contract manufacturers Foxconn Hon Hai, Wistron and Pegatron. Of the three, Wistron has so far invested more than Rs 1,200 crore in its Indian factories. For the PLI scheme in IT hardware products, the IT Ministry received and approved applications from global leaders such as Dell,Wistron, Flextronics, Foxconn, and 10 other leading domestic players.

While the nodal ministry for the implementation of mobile phone as well as IT hardware PLI is the IT Ministry, the Ministry of Communications is overseeing the PLI for telecom and networking products. Similarly, under the PLI scheme for food manufacturing, which has an outlay of Rs 10,900 crore, the government had received more than 250 applications.

There is also a high degree of interest in the Rs 15,000-crore PLI scheme for Pharmaceuticals. 95 applicants had registered for this scheme, which has 55 slots in total. The PLI scheme for critical bulk drugs too received as many as 215 applications. Of these, the government had selected 47 applicants spread across the four target segments in focus for the scheme. However, this scheme too requires additional applicants to fill around 10 slots for a few bulk drugs for which there were fewer applications than was needed.

As per Indian Pharmaceutical Alliance secretary general, Sudarshan Jain:“The industry is very excited about this PLI scheme. Significant and very strong stakeholder consultations are taking place (with the Department of Pharmaceuticals) and the industry is looking forward to participating very actively. The DoP has been “deeply” involved in providing clarifications regarding the submission process for this scheme, according to him.

Originally intended for the manufacture of finished goods such as air conditioners (ACs) and LED lights, this scheme for White Goods was restructured and announced for component manufacturers of ACs and LED lights. The investment and incremental sales thresholds outlined here have posed a challenge to several manufacturers as they are considered higher than the industry norms. This scheme is open for applications until 15 September 2021.

Currently, the nation largely relies on imports of solar PV modules and cells. Designed to combat this issue, the scheme for Solar PV module has drawn considerable attention from potential investors.The success of this scheme would reduce import dependence in a strategy sector like electricity, thereby, increasing its significance.

The scheme also promotes local procurement, thus triggering a cascading impact of the incentives.This is expected to boost creation of ancillary units and augment the entire solar PV manufacturing ecosystem.The investment arising from the scheme is expected to create an additional 10,000 MW capacity of integrated solar PV manufacturing plants.

Renewable energy continues to be a niche space, despite its undeniable significance. Presently, there is nominal investment in this space in India, despite the varied applications. Under the scheme for The Advanced chemistry cells (ACC), investments will be approved through a bidding mechanism for creation of cumulative 50 GWh of ACC (with additional 5 GWh for niche ACC) manufacturing facilities in India. This will support the battery requirements towards electronics, EVs, renewable energy power grids and the like.

Sector wise stage of applications

Progress up to the Evaluation stage

In the food processing segment, this scheme was met with an encouraging response from investors of all sizes. A key differentiator here was the inclusion of contract manufacturers, who play a key role in the sector. Currently, approximately 275 expressions of interest received under this scheme are being evaluated and the results are awaited.8

In the telecom sector, this scheme intends to take the nation closer to becoming a manufacturing hub of telecom and networking equipment.This development will automatically offset the heavy reliance on imports in this niche space. While the 36 applications received are currently being evaluated, major global players have expressed an interest to expand in India based on these incentives. These incentives also go hand in hand with other initiatives for the manufacturing industry such as state incentives,‘Manufacturing and Other Operations in Warehouse Regulations (MOOWR), and the 17% corporate tax rate. Viewed together, these offer composite financial support to manufacturers and should be assessed cohesively.

Road ahead

The industry has huge expectations from the PLI scheme.The companies, with an investment plan in hand, must approach the Ministry to make representation for inclusion of their product under the scheme. Further, it is imperative to prepare the sales and growth projections, which lie at the heart of the scheme, beforehand to avoid any last-minute delays in filing applications.

The basic preliminary information requirement list under the scheme would be similar to those provided in the other PLI schemes such as basic company details (memorandum of association, article of association, incorporation certificate, shareholding pattern etc.) and financial details (annual reports, audited financial statements, sources of fund and projections). If the documents are in place at the outset, the applicant could then focus on finalizing their projections in line with the guidelines of the scheme.

Footnotes:

2.https://www.business-standard.com/article/economy-policy/pli-funding-for-solar-manufacturing-to-be-raised-to-rs-24-000-cr-minister-html

3. https://www.pib.gov.in/PressReleasePage.aspx?PRID=1710134

4. https://www.grantthornton.in/insights/articles/pli-scheme-for-the-automotive-sector-towards-an-atmanirbhar-bharat/

5. 5 https://www.business-standard.com/article/economy-policy/govt-includes-cng-lng-98-other-advanced-tech-under-auto-pli-scheme-121111101875_1.html

6. 6 https://indianexpress.com/article/business/pli-schemes-evoke-mixed-response-it-mobile-steal-a-march-on-other-sectors-7399904/

7. https://economictimes.indiatimes.com/small-biz/sme-sector/a-stitch-in-time-why-the-govt-needs-to-iron-out-the-issues-in-pli-scheme-for-

textiles/articleshow/82474956.

cms?from=mdr

8. https://www.ey.com/en_in/tax/india-tax-insights/production-linked-incentive-schemes-in-india-the-journey-so-far