In the first half of 2021, RGICS undertook a study to evaluate the necessity and feasibility of setting up one or more HMED (Health and Medical Equipment and Devices) manufacturing parks in India, so as to lay the foundations of India’s future emergence as a Medical Tech manufacturing powerhouse by 2030. The paper took us through many aspects of India’s HMED industry. We present some of the salient portions almost as they appear in the paper, to give the reader a concise version of things.

Components of the Healthcare Industry

The following diagram shows all the players in the HMED industry, with the ones in yellow labelling being the makers and end users and the ones in white being the facilitators.

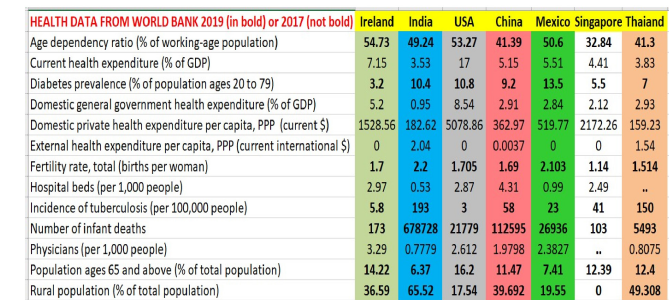

How India Compares with Other OECD Countries in Healthcare

The United Nations captures vital parameters of Health, Nutrition, Population, etc. providing the overall ‘Healthcare Scenario’ for India as follows

The above table shows 2019 (and sometimes 2017) data from many OECD countries, across multiple health and nutrition parameters. Source: World Bank Data Archives, accessed in July 2021. As is clear from the table above, India lags in most parameters.

The Size of the Medical Industry in The World And In India

As per a study by Wolters Kluwer, a global health and information systems company based in the Netherlands, “the global medical devices market in 2020 was valued at $456.9 billion, which is an increase at a compounded annual growth rate (CAGR) of 4.4% since 2015. Despite an expected decline of -3.2% in 2020, it is expected to rebound in 2021 with a 6.1% CAGR and reach $603.5 billion in 2023. With rising incomes in the more populous middle and lower-middle income countries, including China, India, Indonesia, Brazil, Bangladesh, Nigeria and Mexico, the demand for HMED is only going to go up faster. Thus, we are looking at a potential trillion-dollar sector by 2030, globally. The domestic market for medical devices in India in 2017 was around $11B, which accounts for about 4% of the overall Indian healthcare market.

Main Drivers of Growth of the HMED Industry in India

- Increase in chronic diseases, especially non communicable diseases (NCDs) including diabetes, cardiovascular diseases, chronic obstructive pulmonary disease, and cancer. This category NCD is likely to constitute upwards of 75% of India’s disease burden by 2025 (it was 45% in 2010). Other top NCD include cancer, cardiac diseases, stroke, pressure etc.

- Another factor driving growth in HMED is our ageing population – the percentage of people above 65 is steadily increasing, though on the whole India is has a lower median age than most developing countries (and almost all developed countries).

- A third factor aiding growth, is the rising income in India, resulting in bigger demand and affordability for healthcare. India’s population segment with more than $5000 annual income is expected to touch 450m by 2025 and only poised to grow since. Hence the percentage of household income spent on healthcare is expected to reach 13% by 2025.

- The number of people with health insurance is also currently lower than 50% of the population – implying that, thanks to rising incomes and benevolent new government schemes, the number of insured people is also expected to rise.

- Of late the Indian government has implemented many policies to address the challenges of the health care sector – from allowing 100% FDI in the HMED sector, to Make in India initiative, coming up with a reliable standardization and certification framework etc. In July 2015 the government announced a plan to open a medical college in every district.

- Another growth driver of HMED is increased affordability and penetration of mobile phones and internet, which increase awareness about the need for healthcare among the rural population, which now can also be served remotely, through telemedicine.

- Hospital industry in India is expected to reach USD 132 bn by 2023 to USD 61.8 bn in 2017 practically growing at a CAGR of 16%. In 2016, the hospital infrastructure in India had a shortage of beds – India has an estimated 1.1 beds per 1,000 people which is far behind the WHO recommendation of 3.5 beds per 1000 people. India needs 4 million beds for the recommended capacity. And this increase in beds will further drive the demand for medical devices.

- Healthcare costs in India are among the lowest in the world even after adjusting to purchasing power parity. This attracts people from other lower income countries for medical treatment to India. Indian Medical Tourism market is growing at 18% y-o-y and expected to reach USD 9 bn by 2020.

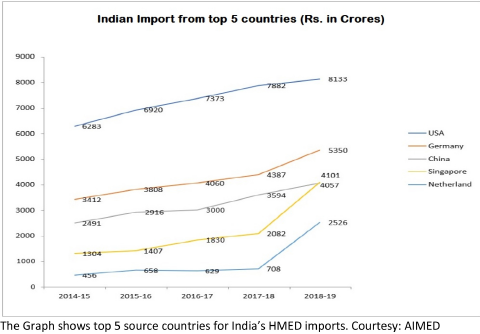

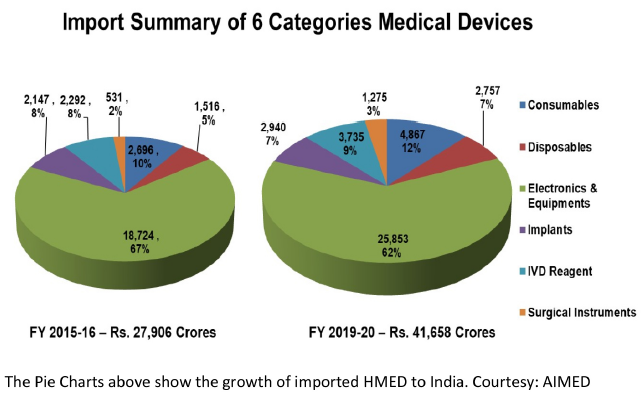

A Snapshot of India’s Import Dependence in HMED

India currently has an 80+ % import dependency on medical devices – costing around Rs 42,000 crore yearly. Most of the imports are from USA, Germany, Netherland, China and Singapore. The USA dominates the Indian HMED import scene, with Singapore and the Netherlands showing the highest growth in recent years. While USA is the biggest source country across all types of HMED except “Disposables” (where Singapore dominates), the type of HMED where India’s import from USA is highest, is the “Electronics Equipment” segment. This segment is also the biggest segment of import for India from all the other top countries. Diagnostic imaging is the largest segment within this “Electronics Equipment” and also in the overall Indian medical device market, expected to touch USD 2.47 bn in 2020.

Current Structure and Problems of the Indian HMED Industry

Most of the Indian manufacturers of HMED make things at the lower end of the technology spectrum and are highly fragmented, with over 1000 mostly small firms manufacturing HMED without benefiting much from either of economies of scale or scope. However, things are looking up – quite a few mergers and acquisitions have taken place among domestic Indian HMED manufacturers recently and some Indian companies have even bought international HMED companies, in an attempt to gain market access and tech prowess. The medical devices industry growing at a CAGR of 15% holds the highest potential amongst all sectors of the healthcare industry. However, India has an import dependence of upwards of 80%. HMED is the 20th most exported product in the world and the global export market for medical devices and equipment is around $117B2 of which India exports about $2.1 bn worth, mostly in low tech and/or inexpensive MED.

The domestic HMED industry has not been able to grow with the demand, neither in volume nor in the level of technological sophistication needed for certain devices – leading to a dependence on imports of up to 80% in some HMED segments. Some of the main reasons for reaching such a situation and for finding it tough to change this paradigm are as follows –

- The regulatory process for HMED used to fall under Drugs and Cosmetics Act and is a major hindrance. It causes delays, often up to two years (for implantable devices). Such time lag may be justified for the Pharma industry but in HMED it only acts as a hindrance. Things have improved after the notification of Medical Devices Rules, 2017.

- The import duty structure (zero to 5% basic duty + nil special additional duty or SAD) incentivises Indian industry to import and trade as opposed to getting into manufacturing. As per AIMED, when there is nil or low import tariff structure and foreign Governments like China are giving subsidies of up to 17% to their HMED Industry for export, no Indian player wants to take burden of manufacturing and even experienced Manufacturers take easy route of importing and selling in India.

- Possibly as a consequence of the above, the Indian HMED sector also invests very sparsely in R&D and relies on a mix of technology transfer and reverse engineering. To change this paradigm, the government should incentivise expenditure on R&D, either in house (in the MED company) or by commissioning Indian research laboratories, with fiscal benefits like tax rebates and subsidies.

- As per the authors’ interactions with AIMED, most Overseas MNCs are not keen to set up factories in India since they have no barriers to market access, but instead have been given free access, with negligible Custom Duties between 0 to 7.5%. Though, Health Cess of 5% was imposed in Budget 2020, it was withdrawn along with Basic Custom Duty on some Medical Devices, due to lobbying by the Indian subsidiaries of overseas MNCs.

- Indian manufacturers are facing further loss of competitiveness post GST, since now the cost of imports is down by 11% as importers can avail GST input credit which they earlier could not. Direct importing not only takes away local employment generation opportunities but also drains valuable foreign exchange and slows down the Economy.

- India used to lack indigenous certification agencies to enforce quality control. The HMED approval process also takes a lot of time, delaying the product life cycle. Lack of IP protection laws also deters global players to invest in R&D in their India operations.

- Setting up manufacturing facilities in India often come with logistical issues. India, as of now does not have an effective transportation and component supply chain infrastructure in place. Most of the components for domestic manufacture, are also imported – so in order to facilitate HMED manufacturing in India, we have also to first upgrade the HMED components manufacturing and supply ecosystem.

- India ranks low in the ease of doing business for reasons ranging from unnecessarily complicated regulations to unfavorable labor laws and lack of skilled workforce needed for carrying out installation, repair and service work.

The Proposed Three Phase Strategy

At present, we import low tech HMED from cheap export hubs like China and import high-tech HMED from developed countries like USA. To break the status quo and emerge as a manufacturing powerhouse, India has to incentivize local production while discouraging imports, foster tie ups between research laboratories and HMED manufacturers, increase exports even if it means selling at a loss initially, encourage med-tech start-ups and medical tourism, empower the insurance industry and bring about stricter regulations and smoother coordination among the many segments comprising the healthcare industry.

India would have to expand as well as stabilize the domestic demand for HMED sector products. After this, a three phase strategy is proposed to develop India into a global manufacturing hub for the HMED Sector. In the first phase, we should focus on boosting capacity in routine and lower tech HMED items like Clinical and Digital thermometers, Syringes, Stethoscopes, Oxymeters, Oxygen Concentrators, Catheters and Electrocardiographs which were mainly imported from China, directly or through Singapore. These kinds of items can not only be easily manufactured in India but also must be manufactured here. If cost is an issue, we should put our best engineers to work to meet and beat the costs of imported items. This just requires a dedicated task force to do so.

In the second phase, in the Coming Five Years we need to get into manufacturing Medium Tech HMEDs like Electrophysiology probes and lead wires, diagnostic ultrasound scanners, wearables/disposable smart health monitors, implants/prosthetics, patient-aid equipment and instruments. Two related industries where India has reasonable manufacturing capability are (i) plastics and metal work and (ii) customized circuits. In the third phase, in about a decade, India can manufacture for domestic use as well as exports of high tech times such as X-ray generators for X-Ray based diagnostic systems, Computerised Tomography (CT) scanners, Magnetic Resonance Imaging (MRI) scanners, Hemodialysis systems, Cancer care devices, and Anaesthetic devices.

New Developments in the Indian HMED Sector On the Horizon

The Andhra Pradesh MedTech Zone Limited (popularly known as AMTZ) is an enterprise, incorporated in April 2016, under the Government of Andhra Pradesh, a 270 Acre dedicated zone for Medical Device Manufacturing. It is a first of its kind Med Tech Park in India. Their objective is to be a “One stop Shop” of all support systems of Med Tech and thereby simplify operations and reduce the cost of production. Their final aim is to reduce import dependency, make healthcare affordable to Indians and put India in the global map of HMED export.

Aside from India’s high dependence on imports, another motivation for setting up the AMTZ was that HMED manufacturing often requires certain facilities and equipment which are prohibitive for individual companies to set up – so AMTZ gives them a shared alternative. One more advantage is that the AMTZ is in an area near industrial corridors and is well connected by rail, road, air and sea. AMTZ has been acting as a national resource centre for building the HMED sector and has helped several other states, including Kerala, Tamil Nadu and Telangana to set up med tech parks. The CEO of AMTZ Dr Jitendar Sharma is also a Senior Advisor to the Niti Aayog and was involved in formulating the National Policy on Medical Devices, 2017.

Part of the same AMTZ facility is the Kalam Institute of Health Technology. KIHT has access to both HMED academia and industry and aims to facilitate focused research on critical aspects pertaining to medical devices by supporting institutions involved with R&D, industry, policy makers and knowledge repositories. Among other things, KIHT does the following –

- Undertakes HTA (Health Technology Assessment) to appraise the innovative medical devices in terms of their clinical and cost effectiveness.

- Undertakes systematic review and meta-analysis of medical devices and health policies

- Supports repository of medical device-specific best practices, technology upgrades, skill building programs and knowledge sharing platforms.

- Undertakes research and analysis about concerns, rapid action requirement and long term strategy in Med Tech industry

They also do the following –

- Act as knowledge repository for export and import data on medical devices

- Act as advisory board on all matters relating to medical device sector

- Act as an advisory board on policy matters pertaining to medical devices

- Act as bridge between Start-ups and Corporates, and analysing Investments and advising accordingly

In an effort toward indigenous MedTech infra building, Govt. of India announced sub-scheme viz. Assistance to Medical Device Industry for Common Facility Centre under the umbrella scheme for Development of Pharmaceuticals Industry. Under this sub-scheme, financial assistance to the tune of Rs.25 Crore or 70% of the project cost, whichever is less may be provided for creation of common facilities under any Medical Device Park promoted by State Governments/State Corporations. Department of Pharmaceuticals has received three proposals under this sub-scheme from (i) Telangana Medical Device Park, Telangana (ii) Kerala State Industrial Development Corporation (KSIDC), Kerala & (iii) HLL, Medipark Ltd (HML), Tamil Nadu. Department of Pharmaceuticals has given ‘in-principle” approval to all the said proposals. State Level Initiatives. The next generation HMED tech parks came up with the mentorship of the Andhra Pradesh Med Tech Zone (AMTZ) in the three southern states of Kerala, Tamil Nadu and Telangana and one was announced in Punjab in 2021.

Developments That Auger Well for Our Tech Knowhow in HMED

India has taken some steps for fostering MED start-ups. A research collaboration was set up between Stanford University and Department of Bio Technology which led to the development of a prosthetic Jaipur Knee which costs less than 1% of the titanium alternative. In 2018, Government of India and the World Bank also signed an agreement to help India in developing innovations in pharmaceutical and medical devices. The ‘Innovate in India for Inclusiveness Project (I3)’was awarded to BIRAC, which stand for Biotechnology Industry Research Assistance Programme.

SAMEER (Society for Applied Microwave Electronics Engineering and Research) was set up as an autonomous R & D laboratory at Mumbai under the then Department of Electronics (now MEITy), Government of India with a broad mandate to undertake R & D work in the areas of Microwave Engineering and Electromagnetic Engineering Technology. It has branches in Mumbai, Chennai and Kolkata. SAMEER is pursuing research and development in the field of Opto electronics, Medical Electronics, Radar based instrumentation, Atmospheric remote sensing & Meteorology, RF & Microwave systems and components, Navigational electronics etc. Most of the work regarding the development of high-tech Medical devices is carried out in Sameer Mumbai. Many of its R&D outputs and spin-offs have found applications and acceptance in industry. SAMEER also developed Linear Accelerator at a nominal cost, a hi-tech machine used in Oncology for radiating carcinoma, whose global market is dominated by American Varian Medical Systems, Inc. (merged with Siemens Healthineers in April 2021) and Swedish Elekta. Aside from this, there are host of Med-Tech start-ups and incubators and accelerators coming up to make diagnostic and prognostic devices, typically at the lower end of the tech spectrum.

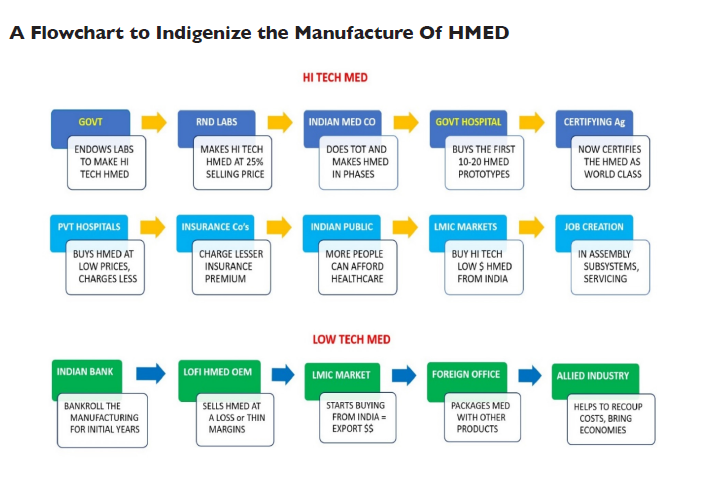

Based on the authors’ one-to-one interactions with R&D Labs, Manufacturers etc., they recommend these two strategies for (a) indigenizing High Tech HMED manufacture and for (b) increasing out export footprint in the low-tech segment. In a nutshell, India has to play a double game – catch up with technologically advanced counties like USA, Germany etc. in the high tech HMED sector and match the low price-points of countries like China in the lower end HMED segment (e.g.: disposables), by initially selling at a loss to grab export markets, and then letting the economies of scale and scope kick in and make the process sustainable over the long term.

Conclusion

One thing which was very clear form their paper is that the Med-tech sector does not work in isolation – to improve it, India has to bring about improvements across the board – in rules and regulations, certifying agencies, financing, insurance sector, healthcare (hospital) sector, medical colleges et al. Hence the dynamics of healthcare segment is a copy book case of the chain being only as strong as the weakest link – even if we leave any one segment unattended, it will bring the whole HMED sector down. On the other hand, to improve the paradigm, we have to improve all the linkages proportionally. On the whole, the situation is rather dismal – currently, most of our HMED is imported, only a few Indians have insurance, there are lot lesser hospitals (beds) than needed, there are few Indian OEM’s (most are foreign) and also fewer trained personnel (doctors and nurses) than required, which is itself because of fewer medical colleges!

So, the overall healthcare industry seems to be playing a “low volume, high margin” game. The thrust of their recommendations was to shift things towards a “high volume, low margin” paradigm (making insurance and healthcare available to as many Indians as possible) and attaining production sufficiency (i.e. indigenizing HMED). That is on the quantitative side – on the qualitative side, they suggested changes which will hugely increase industry-laboratory cooperation, reduce imports, raise HMED production and exports, improve regulation, financing and certification and/or standardization and raise general awareness about health.

According to the authors, to really turn things around and firstly become self-sufficient in HMED equipment manufacture and then become a hub of HMED export, India has to improve on two fronts simultaneously. We need to catch up with the developed countries in technology and also match the low-price points (for low tech HMED) of manufacturing hubs like China. As for the changes required in the overall scheme of things under the aegis of which India’s HMED manufacturing industry operates, they have been elaborated in their state and national level recommendations. Even if most, if not all, of these changes in the factor conditions can be brought about within a short span of time, then the paper asserts, there is every reason to be hopeful, that within a decade, just like India’s pharmaceutical and automobile industry, our HMED industry also will become not only self-sufficient but also a flourishing global manufacturing powerhouse.