Editor’s Note. The RGICS had been conducting a study on the above topic since early 2019 and the Final Report was written a little before the time that the COVID-19 pandemic broke out. Since March 2020, the sentiment against China has hardened. Thus suggestions of any type of heighted collaboration with China are received with skepticism. This is not the first time we have faced this. For example, even earlier with the Doklam incident, there was a rise in tensions and fall in investments, which turned out to be temporary. Since then, major investments such as the Industrial Parks in Gujarat were cleared and a lot more Chinese funds invested in Indian ventures.

Even recently, India has imported medical equipment, N95 masks and personal protective equipment, from China to deal with the COVID crisis. The Indian Ambassador to China, Mr. Vikram Misri said that India plans to resume discussion on “outstanding trade issues” with China once the COVID situation stabilizes. In this spirit, we present the summary and highlights of this study.

This research study analyses India-China Trade and Investment from both the demand side and supply side. On the demand side, India wants to augment investment in its manufacturing sector for generating growth with employment; on the supply side there is a strong economic rationale for China to trade and invest in India.

India-China Trade: Profile and Issues

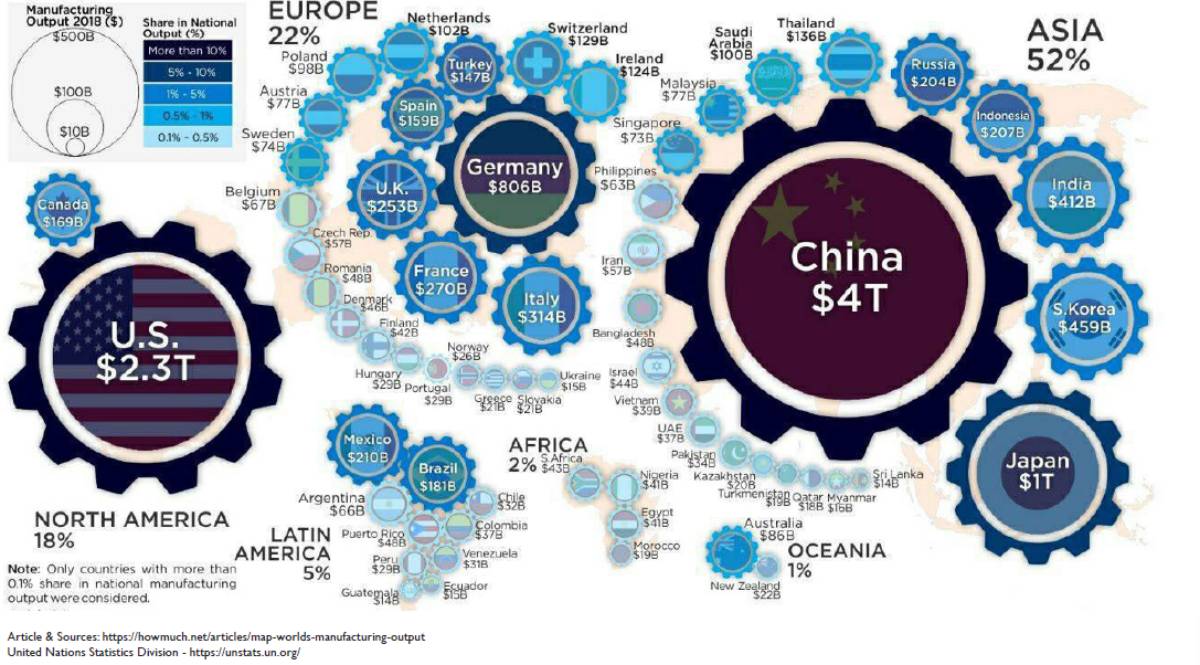

China is India’s 2nd largest trade partner after the USA. It accounts for 5 per cent of India’s exports and 14 per cent of imports. There is a serious problem in the area of trade deficit with China which is almost 39% of India’s total trade deficit of USD 162 billion1.

Some of the key sectors of the Indian economy are critically dependent on China. In 2017-18, almost 60 per cent of India’s import requirements of electrical and electronic equipment were met by China, as were more than 75 per cent of the active pharmaceutical ingredients (APIs) used by India’s generic pharmaceutical industry. Intermediary and capital goods such as steel, machine parts, chemicals and APIs help India’s small and medium enterprises thrive. Many goods of Chinese origin are components of finished goods which India exports to the rest of the world, pharma and auto ancillaries are important examples.

The broad sectoral trends of the exports of China and India show that for the latest year, manufactured products constituted 55 per cent of India’s non-oil exports to China, while the corresponding share of China was as high as 95 per cent. There are deep concerns about Chinese restrictions and industrial policies for market access into China.

Restoring balance in trade relationship with China has been one of India’s priorities. Following the Wuhan summit (2017) both sides have engaged in follow up negotiations. These have so far yielded rhetorical commitments and marginal outcomes, but failed to ease fundamental Indian concerns. Policy makers have to find ways to manage this huge deficit given that India can neither limit its economic engagement with China in the short term nor continue such a huge trade asymmetry for long.

Chinese Investments in India: Profile and Issues

China ranks at a low 18th position in terms of cumulative FDI inflows compared to various countries investing in India. For China, India figures only after top 30 FDI destinations countries. In the cumulative FDI equity inflows, 80% have been received since 2014 onwards. China is a relatively late entrant in the Indian market.

Chinese FDI investments estimated in July 2018 range at USD 11-12 billion with ~700 active companies in the market. There is major investment in mobile telephone manufacturing – China brands now account for over 51 percent of the smart phones sales in India. China’s venture capital investment in the Indian startup ecosystem grew five times at $5.6 billion in 2018 compared to $668 million in 2016.

China’s tech giant companies and venture capital funds have become the primary vehicle for investments in the country – largely in tech start-ups. Chinese companies are also catering to Indian retail consumer via e-commerce and physical retail route. This is different from other emerging markets where Chinese investments are mostly in physical infrastructure. In addition, Chinese companies have done well in securing contracts from Government organizations in sectors like electric vehicles, power equipment, infrastructure (esp. railways and metro), construction equipment, optical fibres, telecom equipment, etc.

Chinese funding to Indian tech start-ups, unlike a port or a railway line, is mainly to invisible assets of small sizes rarely over $100 million – and made by the private sector. However given the deepening penetration of technology across sectors in India, it is making an impact disproportionate to its value. This means that China is embedded in Indian society, the economy, and the technology ecosystem that influences it.

So far, majority of Chinese manufacturing FDI in India has landed in provinces Andhra Pradesh (Sricity, Vishakhapatnam), Telangana (Hyderabad), Maharashtra (Pune, Chakan, Ranjangaon), Gujarat (Vadodara, Sanand), Karnataka (Bengaluru), Uttar Pradesh (Noida, Greater Noida), and Haryana (Gurugram, Bawal, Manesar).

Manufacturing Industry in India: Status and Policy Recommendations

Before going forward on what can be done for developing a long term mutually beneficial India- China trade and investment engagement, it is important to look at some key points about the manufacturing ecosystem in India. Make in India (MII), one of the first major programs of the new national government was initiated in September 2014 with a vision to transform India into a global manufacturing hub. It set an ambitious target to reach manufacturing share in GDP to 25 per cent by 2022, focusing on liberalisation of FDI policy, emphasis on Ease of Doing Business and improving the infrastructure.

While India has seen record foreign direct investment in this period, it’s began falling even as other countries in Asia are undergoing an investment boom with 2019 doing generally worse than 2018 that was already lower than the previous year. Investments fell to a 14-year-low. Indian companies announced very few new projects, 55% lower than the year-ago period.

The Manufacturing sector has been shrinking to about 15 percent of GDP in 2017, from a peak of 18.6 percent in 1995. In December 2019 the DPIIT Secretary-Government of India, admitted that the situation in manufacturing gross value added (GVA) is “worrisome” with growth contracting by 1% in the July-September quarter of 2019-20 from 6.9% expansion a year ago. The Government is working on the Industrial Policy to raise the share of manufacturing from the current 16.4% to over 20% in GVA.

India should develop an ecosystem conducive to the establishment and growth of manufacturing industry. This holds true for both domestic and foreign investment. We give some policy and strategic recommendations:

a. Moving from a Functional to an Active Industrial Policy Approach

The current focus on improving the ease of doing business is limited as an industrialization strategy; some of the measures are even counter-productive. We recommend Active industrial policies and interventions that guide and promote investment domestically towards new activities and sectors with higher productivity, better-paid jobs, and greater technological potential. Industrial policy should support firms’ participation in global value chains (GVCs) and benefit from their engagement. To some extent this has been successfully tried in the electronics sector (e.g. mobile phones).

b. Changing Labour Laws

India should introduce the practice of Fixed Term Contract (FTC) in the manufacturing sector to give employers more flexibility in employment. Initially there may be difficulty as the labour market phases in this new channel of employment and gets accustomed to it. It is proposed that to enable employers to tide over any transitional problems, for a limited period of say 10 years; they should have the flexibility to hire contract labour for main line production activities.

The law on overtime wages also needs to be brought on par with international practice. Section 59 of the Factories Act, 1948, and Rule 25 of the Minimum Wages (Central) Rules,1950 should be amended to reduce the overtime wages to the level of 125 per cent recommended by the ILO. In order to consolidate the RSKY unemployment allowance scheme, it should be delinked from ESIC and made applicable to all units in the country in the covered sectors.

Developing the labour market will need to be done in small, politically sensitive but economically smart reforms, devolving more power to states, including the informal sector in the reforms dialogue, and discouraging vested interests by sensible incentive mechanisms.

c. Preferential Market Access (PMA) to Domestically Manufactured Products

The Public Procurement (Preference to Make in India), Order 2017 was issued as part of Government policy to encourage ‘Make in India’ but has been rendered ineffective. Several qualifying tender conditions ensure that domestic manufacturers do not have a chance at even making an application. A single minded focus on lowest cost procurement has ensured more procurement from China. A Government committee was set up in July 2018 with a mandate to the ease the restrictive and discriminatory clauses being faced by the Indian Industry in public tenders. This should be reviewed to ensure Central and State Governments to implement this Order.

d. Design Policy Instruments and Intervention for Identified Sectors and Products therein:

i) Levy of import duties: Graded System without Inverted duties – highest for import of final products, lower levy on intermediaries, parts and components and the lowest on raw materials.

ii) Relief in direct taxes to all units: This instrument is being considered only for mega investments (> 1Bn USD) in Coastal Economic Zones. The reasons that compel a tax break for mega projects apply equally if not more, to smaller units.

iii) Tweaking indirect taxes: This worked at least as far as attracting investments into cell phones. Recently the GST has been hiked to 18% from 12% which has reduced the scope considerably. The continuation of the 12% dispensation in the GST regime is now essential for the assembly operations to continue. Deepening this value chain will require extending the differential to parts and components in a phased manner. As of now, the mechanism works only for Customs duty.

e. Promote MSME Clusters

A higher budget allocation for cluster development of enterprises is recommended. Promote FDI in the small and medium enterprises sector as presently, the measures taken to promote FDI mainly benefit large industries. Capital for MSME should be enhanced not just from bank credit, but also by access to equity. A specialized stock exchange can be set up for this purpose. For boosting MSME exports, an agency be set up to provide guidance and awareness on standards and certifications for exports.

4 Building Indian Manufacturing through India–China Trade and Investment

In the informal leadership summit of October 2019 between PM Modi and President Xi, steps for taking sincere action to reduce trade deficit and specific products and sectors were identified. China welcomed Indian investment in IT and Pharma in China. A High-level Economic and Trade Dialogue Committee and mechanism were agreed upon: to establish manufacturing partnerships by identifying certain Sectors/ Industries where investment could come in, manufacturing could create employment and enhance the market for both sides. In November 2019, the government ultimately decided not to join the RCEP reflecting India’s challenges of market access for Indian goods and services in China and the fear of a flood of cheap Chinese imports.

India did open up most of the sectors for FDI investments through automatic route, but investments from Bangladesh and Pakistan, which share borders with India, have to undergo government scrutiny. In April 2020, India reviewed its’ FDI policy expanding this restriction to all countries sharing borders with India. With this, the government has now ruled out investments from China, direct or surrogate, without scrutiny. The Government Circular states this is for curbing opportunistic takeovers or acquisitions of Indian companies due to the COVID-19 pandemic.

For building Indian Manufacturing through India–China trade and investment, we give some recommendations on strategy and implementation

a. Get Chinese MSMEs to manufacture in India

Two kinds of industries are being compelled to move outside China, India could be a potential manufacturing base for these:

- Industries with long value chains, which have a large domestic (Indian) Market such as Mobile Phones and Home Appliances

- Export-oriented SMEs like Clothing, Leather Goods, which have a short value chain, low value addition and where the output is directly sold to the final consumer

Chinese MSMEs are keen to venture outside China to set up specialized manufacturing in other countries. Private MSME enterprises do not carry the risk of ties with the Chinese deep state that is associated with large Chinese private players like Huawei, Alibaba etc.

The problem is that people in China have limited access to information about the Indian economy and business environment. This has restricted the relatively mid-scale businesses from China to invest in India. India can identify such MSMEs, and identify which Sectors and provinces of China they are from. This information can be matched with Indian States and Sectors where it can be a good proposition for them to invest and make in India.

We recommend that State, Central Government and MSME associations take up this exercise. Existing traditional MSME clusters can also be developed and upgraded with Chinese financial and technological investment. Our field research shows that this has happened in the Morbi Ceramic Tile Cluster, Gujarat where technology transfer is taking place in a big way.

b. Position “Make in India for the World” as the Theme for New Industries

For new industries (including electronics clusters) efforts should be made to locate them in zones that are cost competitive from export point of view. For this, develop country-specific industrial parks in PPP mode in coastal states. Fourteen Coastal Economic Zones (CEZ) have been identified along the coastline of the country under the Sagarmala Program. CEZ with incentives and facilities similar to those in SEZs would help in attracting investments and in turn boost both exports and domestic production.

India should avoid the tendency to let foreign owned companies tap opportunities in the global trade by using India as a base for last-leg assembly, rather we should strive to make Domestic Champions wherever possible. Domestic champions holding new positions in GVCs can help us retain our competitive advantage in times of disruptions.

c. Chinese Industrial Parks in India

As these parks will be developed keeping in mind the requirements of medium to large scale Chinese factories, Chinese can do the job of projecting India opportunities to their own people better than the Government of India ministries, investment promotion agencies, state government agencies, etc. Recommendations for implementation are:

i) Chinese to support in promotion and facilitation, rather than infrastructure development

ii) Solicit Interest from Indian states interested in setting up Chinese industrial parks: As a first step, Government of India should finalize a term sheet with Chinese government. Conduct a survey to identify states that can fulfill the requirements from Chinese side and fast-track the project.

iii) Encourage collaboration between India and foreign private developers: About 8-10 Indian groups own large land parcels across major industrialized/coastal states. These developers have experience of developing industrial parks and are keen to collaborate with Chinese organizations.

d. Exporting to China

The strategy recommended is focused selection of products/sectors combined with a market-led design of export strategies for each of them. This includes branding and market promotion.

i) Pharmaceuticals and IT

Indian companies continue to have a range of non-tariff barriers in China, particularly in IT and pharma sectors. India must use the strength of its service and software industry to get a bigger market footprint in China. The ministry should look at establishing an interface between the Food & Drug Administrations of India and China for conduct of regular training programs on regulatory standards, processes of filing and relaxing the product registration time to a year from 3-5 years.

ii) World Trade Centre lists 20 Products with competitive advantage

A Report by MVIRDC World Trade Centre, Mumbai has identified 20 products where Indian exporters have a competitive advantage to export to China. Currently India meets only 3.3 per cent or USD 2.7 billion of the total annual import demands of USD 82 billion for these products in China. We recommend exploration of this potential through:

- Exchange of trade delegations with members from these identified sectors

- Create awareness on this opportunity among India’s MSMEs producing them

- Map Indian manufacturing clusters to the cities in China. This will go a long way in establishing the brand pull required to provide comfort to Chinese investors.

iii) Cultural exports and Services promotion

According to Retd. Ambassador Bambawale trade imbalance cannot be managed only by enhancing Indian primary exports. He suggests:

- Attract Chinese tourists in large numbers

- Attract students for undergrad study so they can learn good English and go for higher studies to the US, etc.

- Export Indian films, Yoga and other products/services of our creative and cultural industries.

iv) Focused Export Strategies

For the identified products/Sectors, focused export strategies must be designed taking into consideration the external environment of the particular export market, and can include:

- Skilling and training workers on specialized knowledge about the focus market, specific exports for promotion, language training, etc.

- Mandatory standards for manufacturing with adequate testing and certification bodies. Harmonizing Indian standards with global standards to enhance export competitiveness. A National Standards Mission can be instituted for this.

- Dedicated offices tasked with product promotion with special emphasis on markets could be set up on the lines of UK Trade and Investment (UKTI), Buy USA etc. to engage in export promotion activities and linking Indian exporters with local buyers. Attention must be placed on building and promoting “Brand India”. The brand building initiatives must be integrated with India’s commercial missions abroad through structured engagements with diplomats. To incentivize greater marketing of products overseas, income tax deduction on marketing expenses should be doubled.

Facilitating India-China Engagement (G2G, B2B, P2P)

Chinese provincial economic priorities play a critical role in deciding the limits of their interactions with their Indian counterparts. There has been an increasing mobilisation of provincial party secretaries and officials on trade missions to India. Also seen is a new dynamics, where Chinese municipal and prefectural-level entities are seen exploring possibilities of tie-ups with any of the federal tiers in India.

What’s therefore needed is for engagement to be channelised through lower levels of government and society, such as collaboration among businesses, partnerships in technology development, sharing of experiences in urban planning and management and so on. For this model to be effective, it is better if cities and provinces, as opposed to the central leadership, take the lead.

INVEST INDIA, established in the Ministry of Commerce & Industry, is the national investment promotion and facilitation department. Foreign investors can avail of its services without any cost. In China, the Indian Embassy does not have enough staff to reach out to Chinese businesses. CII has an office while FICCI has a local representative in China. We have to develop a mechanism to help Indians invest in China and vice versa. India Inc. could take up the task.

We further recommend and have framed, a step-by-step process that can be followed by both investment seekers and prospective investors. This can result in effective outcome for industry identification and partnership formation.

Between 2013 and 2015, six pairs of Sister-city agreements and 2 pairs of Sister-province agreements were signed. A State/Provincial Leaders’ Forum was established in 2015 during PM Modi’s visit to Beijing. This was an important statement of intent. Since Wuhan 2017, both sides have established a High Level Mechanism on Cultural and P2P Exchanges and put together a Plan of Action for marquee events in 2020. In October 2019 the Takshashila Institution2 had recommended these steps to take forward India-China engagement:

- Both sides should announce a timeframe to convene the next State/Provincial Leaders’ Forum.

- Both sides should work towards a roadmap for establishing greater connectivity between major metropolises based on sectoral expertise.

- Both sides should announce plans to encourage and facilitate roadshows by provincial and city governments to attract tourists and students.

Since 1997 over the years, a few Indian private non-profit, membership-based agencies and forums have come up. They provide platforms and organise events in India and China, with the objective of facilitating India-China B2B and P2P engagement. A few private Chinese Consulting businesses have been recently set up in India to service Chinese investors to explore and do business in India. There is a China-India Chamber of Commerce & Industry (CCCI) supported by the Chinese Embassy. Chinese Enterprise in India have formed Associations in States/Regions having major Chinese presence. All such efforts can go a long way in building a more organic and cooperative relationship, strengthening it from the bottom-up. This is critical for deepening people-to-people engagement, a key objective that emerged from the Wuhan Summit 2017.

Trust and Security issues between India/Indian and China/Chinese

- Visa Issues: Several relaxations and simplifications were made in year 2019 for Chinese nationals to obtain business or Tourist visas. For Employment visa, Chinese professionals find the process is cumbersome and difficult on several counts. Meanwhile, Chinese nationals are the largest group among India’s neighbors when it comes to workforce who apply for an employment visa to work in India.

- Trust deficit and Insecurity: Among common Indian people there is a widespread level of mistrust of China, Chinese businesses and Chinese people. In the Government and Industry circles there is an awareness and suspicion of the Chinese deep state and PLA connection. On the Chinese side – most people in China know very little about India. There is a lot of negative reportage and news about India. The ordinary Chinese has a feeling of insecurity for their assets when investing in India. There is a large cultural difference between Indian and Chinese people. An organic relationship between India and China is yet to develop. Section (5) above covers initiatives and mechanisms to develop an organic cooperative relationship from the bottom-up.

- Chinese investment and controlling stakes in India’s Digital Sector: A recent Study published by Brookings India states that Chinese investment priorities in India have emerged in the Indian startup ecosystem through venture capital (VC) investment. China’s strategic investments in India’s digital sector and data-oriented services namely Smartphone Apps, Browsers and Streaming Services are sizeable with among the topmost market shares in India. Chinese investment acquiring controlling stakes in certain sectors bring up wider long-term concerns for India: data security, platform control and propaganda.

The following policy recommendations for screening and regulations3 have been made:

- A centralised FDI screening mechanism for the IT-BPO industry to protect citizens’ sensitive personal information from being shared

- Inter-agency committee to review foreign investments involving collection of sensitive personal data

- Data localisation policy

Recommendations for an Indian Agenda

Currently with the ongoing COVID-19 pandemic and global economic and geo-political fallout, it is difficult to predict how the India-China engagement will play out after the crisis. However, the long term need to grow India’s manufacturing sector and employment, and the need to balance the trade deficit with China remains. The issue of Chinese investment has to be seen both from existing and fresh investment points of view. As recommended by the Takshashila Institution4, India should pursue:

- For trade negotiators on both sides to set a publicly stated target for deficit reduction and also identify key sectors to achieve this target.

- Pursue increased Chinese investments in a range of sectors to boost exports and infrastructure development. It is important that bottlenecks such as information gaps, data requirements and land acquisition issues – impeding investments in roads and railways are addressed.

- India should negotiate on technology cooperation and the role of Huawei in 5G within a broader framework of trade reciprocity.

We also recommend that the idea of mutual FDI for addressing global markets at global scale and quality can be explored; so that investment, technology and management may flow from either side to capture global markets and create jobs and growth in both economies.

India should also engage with China in the International Solar Alliance, Shanghai Cooperation Organisation, trans-border rivers and railway station technology. Work together on creating green economies which will go a long way in lowering carbon emissions globally. They should share their experiences in successful mitigation of and adaptation to climate change. The two countries should also collaborate on international negotiation strategies related to emission reductions and how these would be financed. This common vision towards clean energy will ensure beneficial engagement and increased trade opportunities between India and China.

(Mona Dikshit is a Visiting Senior Research Fellow at the RGICS, working on the themes of Growth with Employment and Governance and Development. She would like to acknowledge the inputs in this study by Mr Vijay Mahajan, Mr Mohd Saqib, Mr Arun Goyal, Mr Jagmeet Singh and a number of Chinese business entrepreneurs and Indian Government officials.)